In the first post in our Network Disaggregation Blog Series we offered an introduction to network disaggregation, and highlighted proof points of how it is successfully being applied throughout the mobile network.

Disaggregation partitions traditionally monolithic elements into components that may be replaced or scaled at will. Whether for the entire network, a particular network segment, network element, or major component, disaggregation ushers in a degree of openness and innovation breaking up vendor lock-in that has propped up costs, and hindered availability to new technologies.

In this post, we discuss the business case for network disaggregation, and why now is the time to deploy disaggregation in software defined networks.

Why (and Why now)?

Disaggregation unshackles operators from proprietary, vertical networking stacks that characterized the mainstream for decades. Once hardware and software are decoupled, network operators are afforded Best-of-Breed technology that meet specific goals and priorities. Major benefits of network disaggregation are summarized below:

Avoid Vendor-Lock-in: For many network operators, reliance on incumbent vendor(s) has yielded familiarity, procurement simplicity, and mitigation of risks. Tradeoffs include proprietary data formats and interfaces designed to constrain migration, stratified feature sets to coerce purchase of higher-end (and more expensive) hardware, and significantly higher Total Cost of Ownership (TCO).

Network disaggregation frees operators from vendor-lock-in, and offers:

- Choice– Disaggregated platforms rapidly leverage new technologies that are readily integrated through open APIs and interfaces.

- Advanced Technologies– New technologies that often conflict with incumbent vendors’ proprietary technologies, may be adopted based on operator, and not vendor priorities.

- Business Continuity– Network operators may swap not only components and platforms, but vendors as well, to mitigate exposure to disruptions in the supply chain.

- Open Ecosystems– Operators may take advantage of inclusive and open ecosystems that are governed by a broad community vs. a single incumbent vendor.

Enable the common platform– Open platforms obviate the need for the proliferation of purpose-built devices and provide:

- Agility– Support a wide range of use cases and may be repurposed to address distinct requirements.

- Best-of-Breed– Accelerate introduction of new products, technologies, and open source.

- Scalability– Efficiently deployed in a range of hardware platforms to achieve orders of magnitude of performance.

- Openness– Drive down CapEx and OpEx costs through standards, open source, and ease of integration.

- Streamlined Operations– Minimize hardware, sparing, training, and deployment, and management costs.

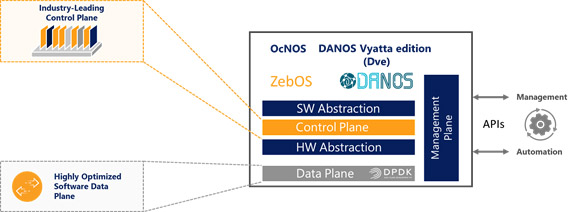

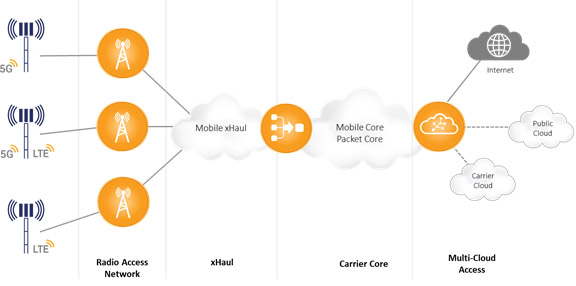

IP Infusion’s common NOS platform (see Figure 1) enables the mobile network from the cell site to the IP core and each segment in between (see Figure 2) featuring:

- Common hardware platform: Scale on white box hardware to enable diverse mobile use cases including Cell Site Routers, Mobile xHaul Packet-Optical and Optical switches, and Carrier Core PE routers.

- Common software platform: Enable platform profiles to be easily configured to support a range of 5G use cases.

- Broad feature sets: IP Infusion’s powerful control plane, refined over decades, supports a range of 5G environments through Layer 1-7 protocols, Quality of Service/Experience mechanisms, and packet-based timing and synchronization.

- Migration: Enable migration from legacy 4G and 3G services to the software-defined future that 5G represents, with minimal disruption.

Figure 1: IP Infusion NOS Platforms Enables Network Disaggregation

Figure 2: IP Infusion NOS platform enables disaggregation throughout the mobile network

Drive Down Total Cost of Ownership — No networking innovations may be implemented at scale without achieving significant cost reduction on both the CapEx and OpEx sides of the ledger. While demands on mobile operators continue to grow at double-digit rates, revenues are shrinking as a result of COVID-19, further depressing prices and margins. Network disaggregation offers compelling TCO advantages:

Reduce Hardware costs: Even as incumbent vendors ratchet down pricing in response to the market, their costs remain relatively high. White box hardware benefit from economies of scale as many vendors coalesce around standards such as the Open Compute Project (OCP), Telecom Infra Project (TIP), and ETSI Network Functions Virtualization (NFV), which have significantly driven down costs.

Open platforms that employ Best-of-Breed components (e.g., optical transceivers, or network silicon) achieve the highest performance at each price point. The ODMs that manufacture open hardware maintain low-overhead to sustain thin margins and highly competitive pricing. Their products lines further minimize OpEx by using standard line cards, optical modules, and spares (e.g., power supplies, fans, etc.).

Reduce Software costs: Fundamental to network disaggregation is the common NOS platform, which may be tailored to support a diverse set of requirements. For the mobile network, a single NOS platform may support mobile transport, carrier core aggregation and routing, and cloud/data center networking. This significantly reduces R&D and support costs, and eliminates the carrying costs associated with each purpose-built device that is replaced.

Carefully crafted abstractions facilitate porting the NOS platform to a family of hardware platforms, to offer a highly scalable solution. Open APIs and standard management interfaces streamline the effort required for orchestration, automation, and network management as well. NFV support optimizes utilization of general-purpose hardware resources, reducing stranded capacity, and space, cooling, and energy costs.

Additional Considerations:

- Common platform vs. purpose-built elements: Common platforms reduce the staffing demands and training costs throughout the entire service delivery lifecycle.

- Migration: Disaggregated platforms are uniquely suited to sustain legacy and existing revenue-producing services, while simultaneously migrating to new architectures.

- Open architecture: By opening up the architecture, disaggregated devices readily enable new technologies, integration internal and external to the device, and lend themselves to rapid adoption of open source, and new technology innovations.

- Flexible pricing and licensing: Incumbent vendor price lists are often voluminous price books with a myriad of options and configurations. Disaggregated devices tend to simplify licensing and pricing to reduce the cost per bit.

Open Ecosystems:

Network disaggregation encourages a vibrant open ecosystem that places the operator in the center. Barriers that exist in traditional partnering programs controlled by incumbent vendors are removed, incentivizing broad participations from vendors large and small. Winners and losers are selected by market forces (vs. incumbent vendors), which motivates continuous innovation and value delivery.

Major technology advancements are available to all, up and down the value chain, which accelerates adoption and greater choice to all. Even though competition increases, the culture of collaboration spawned by open ecosystems results in even greater innovation.

Closing Thoughts

Network disaggregation is reshaping telecommunications, allowing operators to regain control of their networks, and vendors unprecedented opportunities for innovation and market access. Common software and hardware platforms enable the agility, choice, and openness they are seeking, and the highest priority per price point, and lowest TCO. Most of the world’s most prominent service providers, such as AT&T have identified Disaggregation as fundamental to their digital transformation.

For a more in-depth discussion on Network Disaggregation, we invite you download our newly released Network Disaggregation White Paper.

About the Author

Sanjay Kumar is Chief Marketing Officer for IP Infusion and has 20 years of experience in networking technology. Prior to joining IP Infusion, Sanjay held product management positions at Aruba Networks, Aerohive Networks, Broadcom, Cisco and Netgear.